Efficient Cold Chain Logistics Extending The Fresh Journey Of Fruits And Vegetables

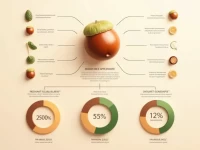

Our professional cold chain logistics service ensures that your fruits and vegetables remain fresh during transportation. We provide tailored solutions, real-time monitoring, and end-to-end support to help you optimize your supply chain, reduce costs, and enhance quality.